Many of the jobs and industries we are now familiar with “will be gone tomorrow”, Mark Carney, the Bank of England Governor, has warned.

The rising speed of technological change threatens to make it difficult to choose a career, and for young people to plan their lives, he said on Tuesday.

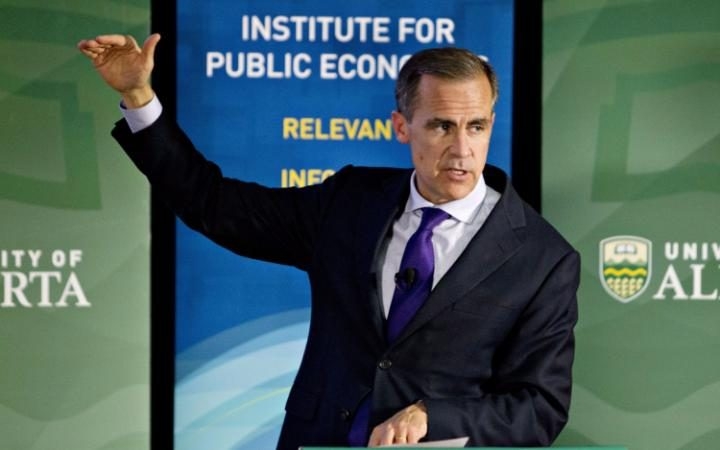

During a commencement speech at the University of Alberta in Edmonton, Canada, the Governor said: “It is entirely unrealistic to map out the decades ahead.”

“Many of the jobs and even the industries of today will be gone tomorrow”Mark Carney

He added that “many of the jobs and even the industries of today will be gone tomorrow”.

As a result, Mr Carney advised graduates to be “flexible and adventurous” as he accepted an honorary degree from the Canadian school, where his father had been a professor.

Drawing on his own experience, the central banker quipped: “I should know because it is a total accident of history that I am Governor of the Bank of England. Indeed, there are many in the UK who are still wondering how it happened.”

He said that in his first big job in monetary policy, as governor of the Bank of Canada, he had believed that he could “set cruise control and not mess it up”. However, he ended up confronted with the “harrowing years” of the global financial crisis.

“So I hope you had fun last night,” Mr Carney remarked. “Because you can always count on a central banker to kill the buzz.”

The Bank chief concluded: “Your generation will determine how well the world commercializes fundamental breakthroughs in areas such as new energy technologies, biotech and fintech.

“And your generation will determine whether we maintain the social capital for shared prosperity consistent with the values of this university and country.”

The Governor’s comments echoed a speech made by Andy Haldane, the Bank’s chief economist, who last year warned that nearly half of all British jobs could be performed by robots in the years ahead.

“Those most at risk from automation tend, on average, to have the lowest wage”Andy Haldane

He said that a new generation of increasingly creative robots could replace “at risk” jobs over the next 20 years, such as those held by accountants and salespeople.

“Occupations most at risk include administrative, clerical and production tasks,” Mr Haldane said, noting that “those most at risk from automation tend, on average, to have the lowest wage”.

As many as 15 million jobs are under such a threat in the next two decades, the chief economist estimated. At the time, there were 33.7 million jobs in the UK, meaning that the number at risk represented close to half of all positions.

Mr Carney said that while some young entrants into the jobs market would face significant hurdles, those “who are blessed with talent and opportunity can reap tremendous rewards”.

In comments first reported by Bloomberg, the Governor said: “Gains to success are magnified in the global marketplace. Now is the time to be famous or fortunate.”

Source: Telegraph UK