There was a time, and it was not so long ago, that western economies would enthusiastically welcome a sharp drop in oil prices.

This no longer seems to be the case.

With oil prices almost halving in the last 12 months – and falling even more in the last 15 months in one of the largest and fastest plunges in history – the phenomenon is now seen by many as more as a curse than a blessing.

Here are the three main reasons why, in rising order of importance; followed by how this perception is likely to change at some stage in the not so distant future.

1. With the surge in US energy production, particularly from shale, the West is no longer as much as a net importer as it once was. So while consumers are unambiguously better off both in Europe and the United States, there are pockets of considerable pain for producers (as well as some banks). The results include output reductions as these companies’ profits evaporate, employee layoffs, sharp curtailment in capex programs and, in the case of highly leveraged companies with debt maturing, acute financial stress. The economy wide effects are amplified by consumers that are yet to rush out and spend the considerable income windfall that accrue to them. Instead, and partially reflecting the financial insecurity associated with years of low economic growth and anemic wages, they are saving an important part of it.

2. When thinking about general price developments, the main focus in the West has shifted from the historical worry of too much inflation to more recent concerns about too little inflation. The challenge of “low-flation” in the United States is amplified by an outright threat dis-inflation threat in Europe. As Mario Draghi, the President of the European Central Bank, re-iterated last week, European policymakers are worried that the sharp oil price fall will accentuate deflationary forces and entice consumers to postpone purchases in anticipation of even lower prices in future.

3. The disorderly manner in which oil prices have dropped has been as notable as the extent to which they have fallen. This has imparted a volatility impulse to financial markets as a whole; and, with the Federal Reserve decoupling from other central banks by embarking on an interest rate hiking cycle last month, these markets do not feel as protected by central banks as they once did. The result is a bout of financial instability as markets transition from a low volatility regime due to effective central bank policy repression, to one of higher volatility whose impact is amplified by pockets of market illiquidity. With that, there is increased risk of bad market technical contaminating real economic activity – accentuated by the possibility of some over-exposed banks.

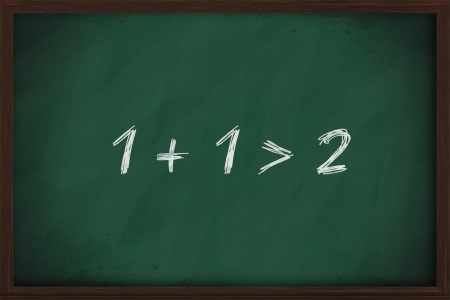

Over time, however, the impact of lower oil prices is likely to balance out a lot more. Most advanced economies (and some emerging countries too) will come out significant net beneficiaries. Their consumers and a notable part of their industrial base will have the possibility – if not probability – of translating their windfall gains into higher economic activity. And this could well be significant … that is provided the short-term transition challenges are managed well.

This post originally appeared on Business Insider.

Author: Mohamed A. El-Erian is the former CEO/co-CIO of PIMCO. He is Chief Economic Advisor at Allianz and member of its International Executive Committee, Chair of President Obama’s Global Development Council and author of the NYT/WSJ bestseller “When Markets Collide.” He authored the book to be published on January 26th, “The Only Game in Town: Central Bank, Instability and Avoiding the Next Collapse”