The recent downturn in Africa’s commodities markets might seem to signal dark times for the continent’s emerging economies. The slump in global oil prices prompted Angola’s government to end fuel subsidies; weak copper rates dramatically reduced the value of Zambia’s currency; and J.P. Morgan delisted the Nigerian naira from the Emerging Markets Bond Index.

But for long-term investors in Africa, these setbacks are blessings in disguise. They exposed the fault lines in sub-Saharan Africa’s growth narrative, but they also emphasized salient new opportunities at both the public and private investment levels.

Depressed commodity prices forced regional policymakers to wake up to the need for diversified economies. In Angola, for instance, the government now recognizes the urgent need to reduce its dependency on oil. Instead of shying away from these seemingly troubled markets, investors should see abundant openings in young but lucrative development sectors.

As Angola and other African countries realize they can no longer invest solely in uncertain commodities, they will further open to other forms of economic stimulation. The following industries represent key areas for investment in the next several years:

Agriculture: Angola is particularly keen to restructure its agriculture industry, as it currently imports 90% of its food supply. Companies can help the country reclaim farmland damaged by decades of war and establish an affordable local production system. In turn, these companies will benefit considerably from investing in the resource-rich nation.

An Israeli firm proved the viability of such an investment in Kenya, where it won a high-priced deal to develop a farm under the Galana-Kulalu irrigation scheme. The farm produced its first harvest earlier this year, and the project demonstrated the opportunities for foreign businesses to help revitalize Africa’s economies.

Industrial manufacturing: The Zambian government recently built a Multi-Facility Economic Zone aimed at boosting the country’s manufacturing industry through increased foreign partnerships. The move could mitigate losses due to Zambia’s weak copper market and, if successful, will demonstrate how other nations in the region can transition to more stable, long-term economic strategies.

Investors need to get in on the ground floor of these opportunities. Growing manufacturing sectors often indicate opportunities to break into new markets and secure favorable deals on pricing and exchanges.

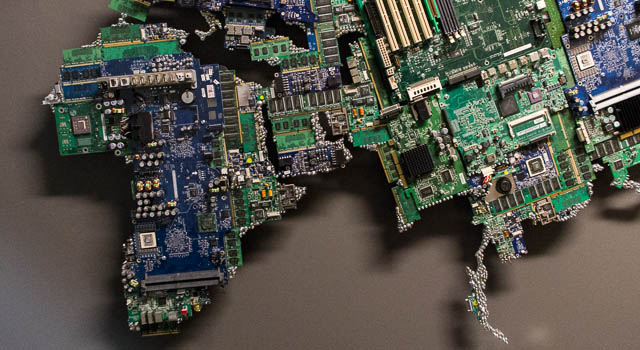

Fintech: Mobile phone use is on the rise across Africa, creating interesting possibilities for banks, investment firms, and other mobile money solutions. In Kenya, the government recently launched the M-Akiba, a state-backed bond only available on mobile platforms. The program aims to encourage people to save and bolster the government treasury. Kenya boasts “the most developed mobile payment system in the world” in Safaricom’s M-Pesa, a system that indicates the massive potential for fintech products in other parts of Africa as well.

Foreign investment projects: International corporations should move now on foreign-friendly markets like Tanzania and Ethiopia. Tanzania recently lifted its 60 percent foreign ownership cap to entice companies to hold IPOs on the Dar es Salaam stock exchange, the best-performing exchange in Africa.

Ethiopia debuted its landmark light rail system in September 2015, thanks to significant funding from the Export-Import Bank of China. Chinese companies built the cars and the power supply. Eventually, they will also train local rail staff. Both milestones signify the growing appreciation of foreign investment’s role in accelerating capital markets.

Sustainability ventures: Foreign companies that provide solutions to socio-economic problems find they can establish strong, long-term footholds in many African markets. Infrastructure, public health, and water resource initiatives represent a small fraction of the areas in need of investment. M-KOPA proved both its sustainability and profit using a combined platform of solar and ICT energy to provide electricity to low-income residences in Uganda, Tanzania, and Kenya.

Investors must realize that developments are lying beneath the veil of crisis that should inspire confidence in Africa’s promise for the next decade. As Africa’s many development projects and policy shifts suggest, the narrative is morphing from a tale of economic need to one of sustained and balanced growth.

Credit: qz.com