Crude oil prices on the international market continue to drop significantly due to the coronavirus pandemic which has affected demand.

On Monday, April 21, 2020, WTI crude, that is oil from the United State (US), crashed, leaving the West Texas Intermediate benchmark settling at -$37.

This has brought about panic, spreading fast across other markets. Brent Crude, oil from the United Kingdom, yesterday, plummeted by over 20 percent and now trading at $18 from $26 per barrel within the spate of 24 hours.

Crude prices in Ghana

Similarly, prices in Ghana have been dropping, albeit marginally, over the last few weeks.

But with the latest drop in prices in the WTI and Brent Crude, consumers in Ghana have begun expect a more significant commensurate reduction in ex-pump prices at the various filing stations to reflect what is happening on international scene.

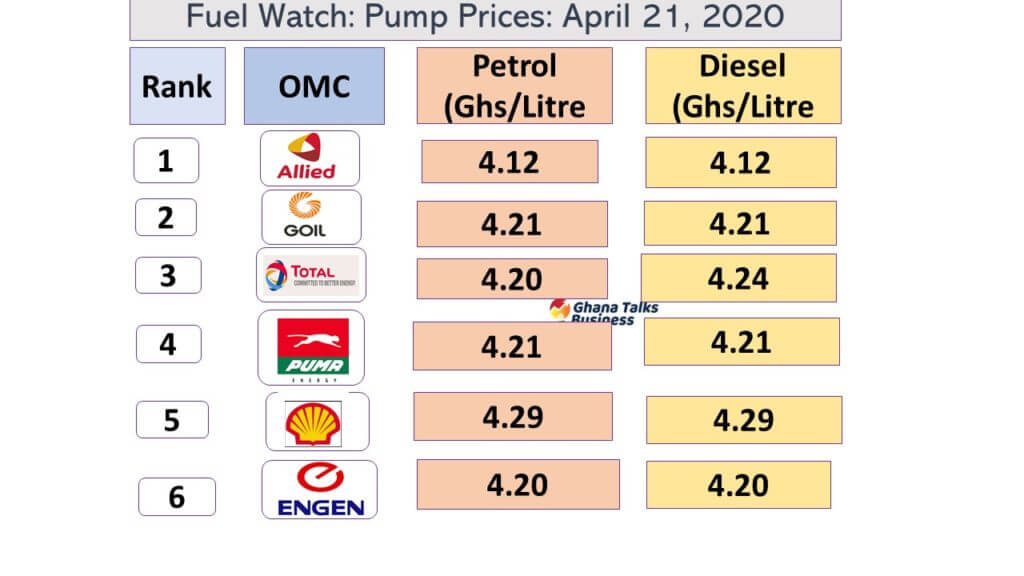

To gauge reactions in terms of price reductions at the pumps,Ghana Talks Business, visited six of the top Oil Marketing Companies (OMCs) to ascertain ex-pump prices that the OMCs were offering.

Below is a table containing the prices of Petrol and Diesel at the filing stations of the top six OMCs in the country.

From the table, fuel consumers could attest that prices have slightly reduced, with Allied Oil offering the cheapest prices at GH₵4.12 for both Petrol and Diesel while Shell’s being the highest, selling at GH₵4.29 for the same products.

Fuel in Ghana- COPEC statement

When the WTI price crashed to -$37 and expectations for a further reduction in fuel prices in Ghana begun picking momentum, the Executive Secretary of the Chamber of Petroleum Consumers-Ghana (COPEC), Mr Duncan Amoah, in a press statement, watered down those expectations.

He said it is “very unlikely” for fuel prices in Ghana to go down due to the fact that Brent crude, whose benchmark the Ghanaian market is largely dependent upon, was by then trading at $26.

“The Ghanaian market is largely Brent benchmark dependent and as such a collapse on WTI is quite unlikely to have any trickle-down effect on local pump prices here,” Duncan Amoah said in the statement on Tuesday, April 21.

He, however, admonished the government take advantage of the situation to help the Bulk Oil Storage and Transportation (BOST) in expanding its capacity to store in large quantities of the fuel.

But it appears Mr Amoah’s press release came a little too early because price of Brent Crude, the benchmark he based in assertion on, has dropped by 20% per cent and now selling at $18 per barrel. This happened on 21st April, few hours after the COPEC statement was issued.

Buying fuel, and why the brand matters

What informs the decisions for consumers to stick to a particular Oil Marketing Company (OMC)? Brand loyalty makes customers patronize fuel from preferred choices as compared to others with relatively low prices?

There are several factors that account for every consumer’s decision to stay glued to a particular pump for years.

In an earlier interview, the Executive Secretary of COPEC explained that there are a number of factors informs the decision of a driver to choose one OMC over the others even if their prices are on the high.

Enumerating the factors that account for the ‘addiction’ Duncan Amoah said Perception plays a key role, and that if an individual perceives an OMC to be selling quality fuel, they see no reason buying from other OMCs.

Loyalty, Mr Amoah said, is also another factor, explaining that if a consumer keeps buying from an OMC for overtime and still has his or her engine in good shape, the person turns to stick to that particular brand.

Quality

Quality of service of product and service makes consumers maintain or keep buying from top brands in the Petroleum sector.

It is the case that top OMCs, like Goil, Total and Shell, mix their fuel with additives to enhance the quality of fuel and hence the performance of engines.

Those additives enhance the quality of fuel which consumers prefer as it helps them to save money on fuel and prolong their engines.