- Ghana, Poland Make First Sovereigns to Offer Debt This Month

Turkcell Comes With Dollar Debt, Gazprom Meets InvestorsPoland and Ghana are among developing-nation borrowers tapping international markets as speculation the U.S. will keep interest rates lower for longer boosts demand for riskier assets.

Poland sold its biggest euro-denominated note since January 2014, and Ghana raised $1 billion with the sale of a 15-year bond. GMK Norilsk Nickel PJSC, Russia’s biggest mining company, became the first in the country to sell benchmark Eurobonds this year on Tuesday, and Turkey’s largest mobile operator, known as Turkcell, is looking to raise $500 million, another person said.

Governments and companies are testing investor appetite after concern over China’s economic slowdown and higher U.S. interest rates prompted a selloff in emerging markets in the third quarter. Bonds from developing countries have rallied in the past week, sending the average sovereign yield to the lowest level in four months, after worse-than-forecast U.S. jobs data fueled speculation the Federal Reserve will push back the timing of its first interest-rate increase since 2006.

“There is a small window of EM relief,” Sergey Dergachev, a senior money manager who helps oversee $13 billion of emerging-market debt at Union Investment Privatfonds GmbH in Frankfurt, said on Wednesday. “I assume some credits want to take this chance, but also providing some concession in order to get the deals placed successfully.”

Investment-grade Poland raised 1.75 billion euros ($1.97 billion) of six-year notes at 0.94 percent.

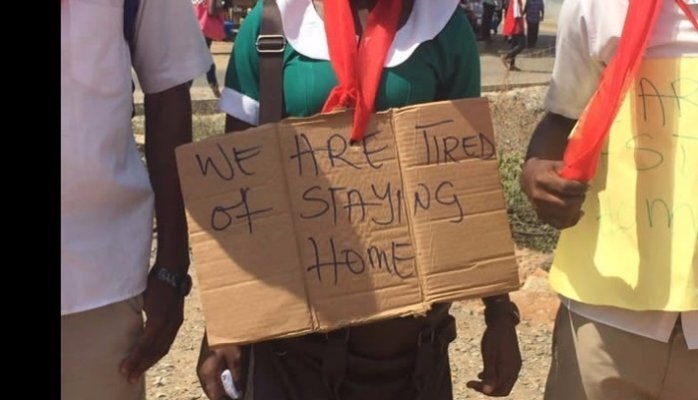

Junk-rated Ghana had to cut the size of its sale and pay a higher interest rate than planned to raise funds. The West African nation was initially aiming to sell $1.5 billion of Eurobonds, according to people familiar with the deal who asked not to be identified because the information is private. At 10.75 percent, the yield on the bonds is higher than the government’s initial target, the people said.

Russia’s Norilsk Nickel paid 6.625 percent to raise $1 billion in a seven-year note, compared with a yield of 5.60 percent on its October 2020 bond. Turkcell Iletisim Hizmetleri AS is offering a 10-year bond at 5.95 percent and it is expected to price today, according to the person familiar with the deal.

Russia’s energy giant Gazprom PJSC is completing investor meetings in London for its first Eurobond in 11 months.

The average yield on emerging-market sovereign bonds has dropped 50 basis points from this year’s peak on Sept. 29 to 4.76 percent on Tuesday, according to Bloomberg USD Emerging Market Sovereign Bond indexes. The resurgence in issues this week follows a 34 percent slide in the third quarter to $62.4 billion as China’s surprise devaluation of the yuan in August roiled global markets, spurring demand for haven assets.

The selloff in riskier assets last quarter led some issuers including Angola to delay Eurobond offerings. The country, which is sub-Saharan Africa’s second-largest oil producer and has its third-biggest economy, last week postponed plans for a $1.5 billion bond to await better market conditions. It now looks to raise as much as $2 billion of bonds on the local market, according to a government gazette.

PGE Polska Grupa Energetyczna SA, which held presentations in Europe last month for a euro-denominated bond, has yet to tap the market.

Emerging markets “are sort of ‘in arrears’ about new issuance,” said Giuliano Palumbo, a Milan-based money manager who helps oversee $3 billion in emerging-market debt for Arca SGR. “The EM net issuance year-to-date is very low on a historical base, so I would expect it will increase until year end.”

Credit: Bloomberg