The country’s total debt stock has hit GH¢205 billion ending July this year.

The latest total debt stock figures was contained in Bank of Ghana’s summary of financial and economic data for September 2019.

This was released after the Monetary Policy Committee met to review the state of the economy and to discuss how to influence the cost of credit in the country.

Breakdown of the debt numbers

The 205 billion total debt stock puts the country’s Debt-to-GDP Ratio at 59.4 percent. GH¢107 billion of the debt was accrued from loans taken from outside the country, working out to about 20.4 billion dollars.

This works out to about 31 percent of the total value of the economy.

On the other hand, domestic debts work out to about GH¢98.3 billion representing 28 percent of the total value of the economy, expressed in percentage terms. GH¢10 billion of the debt was also advanced towards the cleaning up of the financial sector, which the Bank of Ghana classifies as “Financial Sector Resolution Bond”

Rate of increase since last year August

The new debt numbers mean that from July 2018 to July 2019 the total debt stock has gone up GH¢45.8 billion. In just two months the debt stock has gone up by about GH¢5 billion Ghana.

Why debt stock increase?

The increase in the debt stock over the last two months can be attributed to the cedis’ marginal depreciation and recent funds advanced towards the clean up of the banking and non-banking sectors of the economy.

According to the Bank of Ghana, it has spent about GH¢10.7 billion in cleaning up the financial sector.

Based on estimates outlined in the 2019 Supplementary Budget, the cost could reach 21 billion by the end of this year.

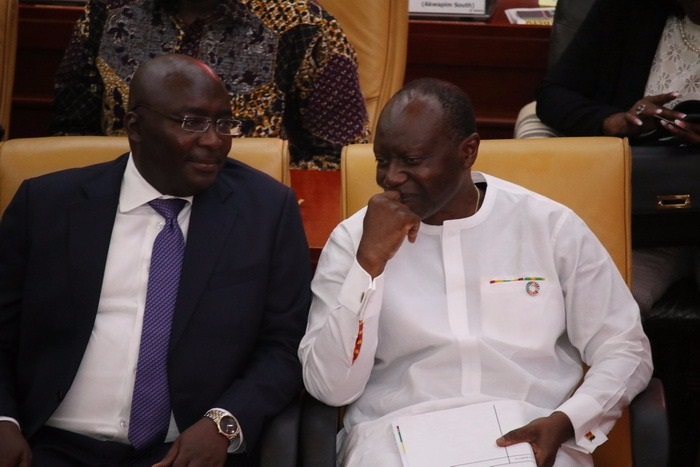

This was after the finance minister Ken Ofori Atta projected in the budget that the clean-up could reach $3 to $4 billion end of 2019.

This new figure is about GH¢3 billion more than what anticipated last month.

How much does every Ghanaian owe?

Based on the GH¢205.5 billion debt, every Ghanaian should owe about GH¢6,850 if the debt is shared among the population size of 20 million.

Impact of rising debt stock on the economy

For some, the impact would be on Ghana’s debt servicing bill. According to the 2019 Budget government is planning to set aside GH¢18.6 billion just to pay for the interest of funds borrowed.

Again if the economy does not expand to accommodate these rising debt, it could impact negatively on the country Debt-to-GDP Ratio, which currently stands at almost 60 %.

Earnings from exports

From the data, Ghana’s earnings from the sector was picking up strongly. Total earnings for the country ending August this year stood at $10.6 billion, up from the $10.1 billion recorded in July in 2018.

Gold brought $4.1 billion, cocoa was $1.5 billion while earnings from crude oil exports was a little over $3 billion. The data showed that earnings from all various traditional commodities witnessed some increase as well.

On imports, the country spent a little over $8 billion to finance what it needs.

Non-oil imports accounted for $6 billion while $1.6 billion went into financing the country’s oil imports.

ALSO READ: Investors Say No Thanks to Ghana Debt Offering Yield Above 20%

This resulted in a trade balance of $2.6 billion. Ghana’s Gross International Reserves ending August this year was $8.2 billion, representing 4.1 months of import cover. While the Net Reserve Position was a little over $5 billion.

The Bank of Ghana puts the cedis’ rate of depreciation for the first 8 months of this year at 9.22 per cent.

This is higher than the 7.57 per cent recorded for the same period in 2018.