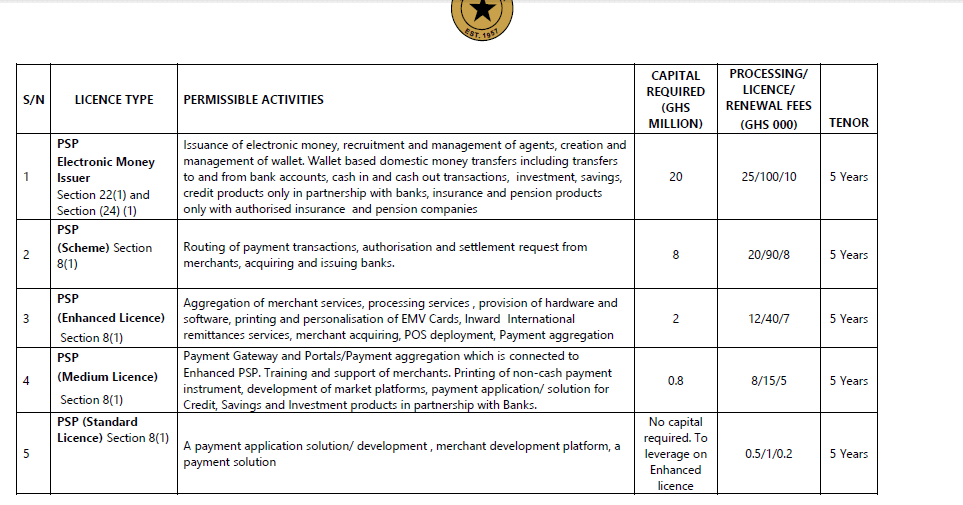

The Bank of Ghana has announced a GH¢20 million minimum capital requirement for operating a mobile money company in Ghana.

The Bank of Ghana said existing firms that are already offering the service will be given some time to meet the new requirement while new entrance will be expected to meet the requirement before receiving their license.

ALSO READ: Why MTN Mobile Money Cannot shut Down

The latest decision comes on the back of the recently passed Payment Systems and Services Act, 2019 (Act 987) which grants a legal and regulatory framework for the orderly development of the country’s payment system.

Below are except of the notice from BoG

Mobile Money Interoperability (MMI) recorded more than 4.4 million transactions in its first year of operation.

Beginning with just 96,907 transactions in its first month, public usage of the cross-network platform grew phenomenally to 422,275 transactions in December last year and 502,873 transactions in May this year.

MMI or seamless cross mobile money network transactions became possible in May last year, following a challenge thrown to the Ghana Interbank Payment and Settlement System (GhIPSS), the Telcos and financial institutions by the Vice President, Dr. Mahamudu Bawumia.

The Chief Executive Officer of GhIPSS, Archie Hesse in an interview described the MMI initiative as successful.