The economic heat has forced the hands of the Bank of Ghana to inch up the policy rate by one percent (100 basis points). The policy rate at 14.5% is how the Bank responded to the economic pressures. The rate was adjusted from 13.5%.

Some prominent indicators have clearly not been kind especially in the last couple of months leading into the last quarter of the year.

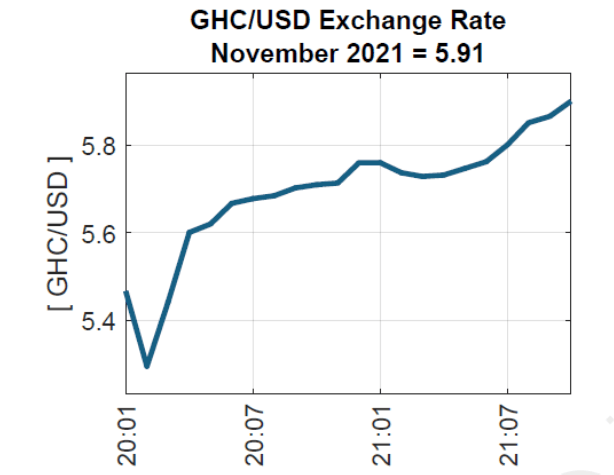

Inflation & Exchange Rate

Inflation, in particular, has seen a steady incline from the mid-section of the year, mainly driven by food and transport costs fired up by the escalating fuel costs. Fuel prices have shot up by over 50 percent from the beginning of the year. This has affected every sphere of the Ghanaian life

.

Even at 10.4 percent, Ghanaians have felt the inflationary heat more than the ‘official’ rate.

This is in addition to the ever-depreciating Ghana Cedi against the US Dollar, which remains a significant determinant of the cost of living of Ghanaians.

The MPC could not ignore the trends and therefore had to respond with the upward adjustment of the policy rate.

What the POLICY RATE will Achieve

The increase in the policy rate will not necessarily curb inflation. This is because inflation, in Ghana’s case, is not caused by ‘more money chasing fewer goods’. The policy rate has thus become a sort of a reactive guide to the status of the economy. Usually, such a policy rate move in an inflationary targeting policy rate regime will be to cut borrowing by making the lending rate more expensive. This is not the case in Ghana as lending to both individuals and businesses is already on the low side.

As depicted by the chart below growth in lending has continued to dwindle in the course of the year;

In this case, the policy rate at 14.5%, in a vicious cycle, will add to the borrowing cost of businesses that have access to loans. These costs will be passed on to the consumers who patronize goods and services from these businesses.

So not much good news on credit to businesses, and the reversal of the current economic fortunes, because the policy is to reflect the inflationary pressures in the economy.

Investments

Possibly for investors, this could be good news. We are in a season where the government’s penchant to borrow is quite high. As government borrows from the public, the upward review of the policy rate will reflect in the promised returns. For investors looking to invest in government treasury bills and bonds. It is a good time. Other private issuers (companies borrowing from the public) will also be forced to adjust their rates upwards. This is not good for them as it will increase their cost of raising funds. However, for the investor, it means higher returns.