Investments are great drivers for wealth building. However, making a wrong investment move can cause your portfolio to crash and burn, thus jeopardizing your financial stance and prospects.

On January 11, the Securities and Exchange Commission (SEC) issued a warning to the general public to abstain from engaging in any capital market activity with CHY Century Heng Yue Group Limited (CHY Mall) and Sairui E-commerce Ghana Limited.

According to the SEC, it has not licensed either company to carry out any capital market activity including investing or trading for returns as mandated by Section 3 of the Securities Industry Act. Both companies do not have the mandate to offer trading platforms for investment products in Ghana

“The general public is hereby put on notice that CHY Century Heng Yue Group Limited/Sairui E-Commerce Ghana Limited have not been licensed by SEC to carry out any capital market activity including investing or trading for returns as mandated by Section 3 of the Securities Industry Act, 2016 (Act 929),” the SEC said in a statement.

Following the warning by the SEC, the Ghana Investment Promotion Centre (GIPC) has initiated an investigation into the allegations of the Chinese firms. In a press statement, GIPC said “Allegations that Chy Century Heng Yue Group Limited is engaged in various activities including Capital Market activities which are outside its registered objects at the GIPC, amounts to an offense under section 40 of the GIPC Act 2013(Act 865).”

“Sairui E-commerce Ghana Limited, which was also mentioned in the publication is not registered with GIPC and as such the Centre has no record of any activity by this particular enterprise,” GIPC further stated.

An insight into CHY Century Heng Yue Group Limited and Sairuir-Commerce Ghana Limited

CHY Century Heng Yue Group Limited (CHY Mall) and Sairui E-Commerce Ghana Limited are both E-commerce sites like Alibaba, Jumia, and Amazon. They both operate under a different model that shifts away from traditional e-commerce sites.

The model allows customers to own an online shop with the CHY MALL platform, purchase products while CHY MALL does the selling of the product on their behalf.

Breakdown of the model

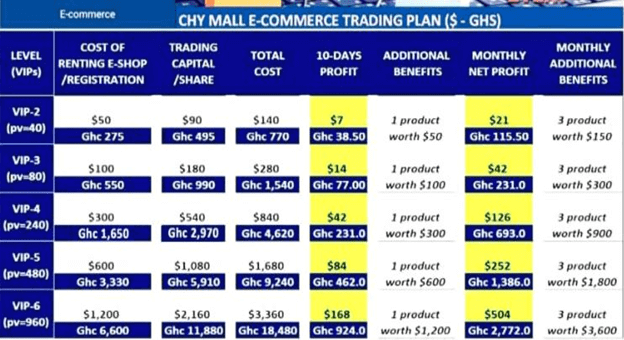

• Individuals first buy a shop on CHY Mall which is the registration phase. The type of shop to buy are at different levels known as VIP Level.

• CHY Mall offers individuals a product for buying a shop.

• Individuals then buy goods and stock their shops. The money brought to purchase the item is referred to as the trading capital.

• CHY Mall sells the goods on the individual’s behalf and pays back the trading capital together with profits to said individual within 10-12 days after the trade.

• The individual can then chose to re-invest into the business and the cycle continues.

CHY Mall is duly registered per the provisions of sections 27 and 28 of the Companies Act 1963, Act 179 and is entitled to commence business in Ghana as an E-commerce.

As stated above, the company is registered to conduct business as an E-commerce and not to engage in investments or any other capital market operations. Sairui E-commerce Ghana Limited also operates under the same model.

During the Banking sector clean-up that began in August of 2017 and the Ponzi Schemes of Menzgold, DKM and God is love that rocked the nation, Ghana’s level of financial literacy had been called into question.

In an interview with Ghana Talks Business, Mr. Dela Agbo an Investment Banker and Chief Executive Officer of EcoCapital Investment Management Limited cautions Ghanaians to learn about investment firms they transact business with.

So, how do you begin to learn about safe investment products in Ghana and the right investment firms?

Choosing the right investment products in Ghana

Many people rely on friends and relatives for investment advice or referrals which should highly not be the case. Your financial portfolio is not the only thing that crashes or burns but your relationship with the person. The best way to choose the right investment firm is by undertaking thorough research.

Thorough research must be done in the following areas:

Firm’s history: Gaining knowledge of the companies origins, products and services, clientele base, growth, successes, failures among others speak of a firms’ trustworthiness and credibility though that might not be enough.

Track record: Only consider investment firms with successful and proven track records. A firm is only worth investing in, if it proves profitable, and is capable of increasing its profitability at a good consistent rate.

Credentials and Accreditations: Ask questions on the matter related to the credibility of the firm such as certification, affiliations, business and staff accomplishments, etc. If this proves a daunting task, the SEC has advised investors to call its toll-free line 0800100065 or main telephone number 0302768970-2 to confirm the licensing status of any firm offering products or services relating to investments in the capital market.

References: Ask for references and make sure to go the extra mile of verifying and validating the references provided.

Costs: Investment firms aren’t Pro Bono. Some investment firms make their profit by charging fees while some others impose a commission on investments. Some investment firms also do both. So make sure to ask questions on costs and do well to decide on what works best for you.