As the impact of the Covid-19 pandemic rages on in Ghana, Government overall revenue is estimated to drop significantly.The pandemic has grinned almost all sectors of the country’s economy to a sudden halt. It has resulted in the folding up of many businesses and impacting negatively on government tax revenue projections for the year. However a few sectors seem to be flourishing in spite of the gloom. A call has been made for Government not overtax the sectors that are booming amid Covid-19.

Gov’t revenue shortfall

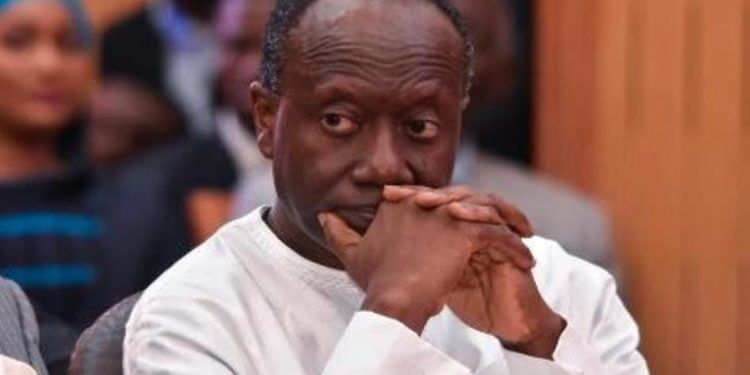

Ghana’s Finance Minister, Ken Ofori-Atta, has already told Parliament, more than a month ago, that government will lose revenue in the 2020 fiscal year to the tune of about US$1.9 billion, which is equivalent to 2.5 percent of the country’s GDP, as a result of Covid-19.

Additionally, the estimated impact on the country’s tax revenue is pegged at GH₵808 million shortfall in import duties and GH₵1,446 million loss in other non-oil tax revenue. Overall total deficit in non-oil tax revenue for the year is estimated at GH₵2,254 million.

Furthermore, figures published by Deliotte indicates that the estimated impact of the pandemic on petroleum receipts for Ghana will be very dire. Hence, there will be a drop in shortfall of about GH₵1,058 million in the Stabilisation Fund.

Also, shortfall in the Heritage Fund is estimated to be GH₵453 million. Gap in Annual Budget Funding Amount (ABFA) is pegged at GH¢3,526m, whereas deficit in transfers to Ghana National Petroleum Commission is forecasted at GH¢642m.

This implies that government may struggle to find revenues to implement its agenda for the year.

In spite of this, there are still few sectors of the economy, such as telecommunication, mining and others that are doing well amid the economic crisis as imposed by the pandemic.

This has necessitated calls by some concerned citizens for the government to increase the tax rate for those sectors of the economy to make up for the shortfall in tax revenue target for 2020.

Ensure business pay the right tax

But A Tax Expert, Mr William Kofi Owusu Demitia, contributing to a panel discuss on the ‘Joy Business Industrialisation Forum’, on Tuesday, May 5, 2020, disagreed with those suggestions.

He argued that even though government may be losing tax revenue in some areas of the economy, increasing the tax rates for those other sectors that seem to be booming at the moment will further compound the economic hardship in the country, as imposed by the pandemic.

“You may be looking at profit rising, but the question is whether in taxing those profit you are not denying them the after tax profit they need to expand. Because remember that in any crisis some people may lose their jobs and they may have dependents.

‘So, you create a dependency within the economy, meaning that people will be relying on others who are already working to earn more to be able feed and look after them”, he said.

Consequently, Mr Demitia, has urged government to put in place mechanisms to ensure that those sectors of the economy that are experiencing growth amid the pandemic, pay the right taxes as required of them.

By Salifu B.B. Moro