It is the last quarter of the year, and we are still looking at twists and turns in the global forex marketplace.

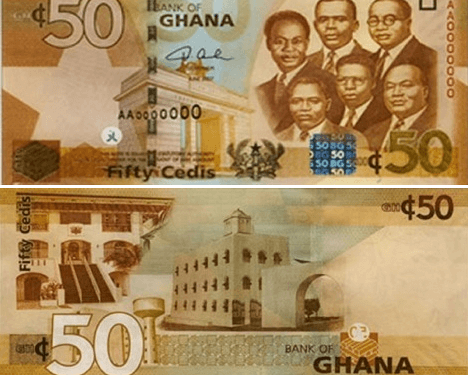

The Bank of Ghana recently introduced stricter regulations in the local Forex market. This was to regulate the flow of foreign currency in the country and protect Ghana’s financial laws. Here are 5 Forex trends that could end up defining 2019.

Macroeconomic trends govern the overall movement of Forex markets. With growing uncertainty, changing regulations, and shifting financial climates, traders and investors are constantly monitoring currency movements in relation to global events. And with the year ending here are some Forex trends that could end up defining 2019:

USD pulling a comeback in Q4

With its impressive performance last year, there was a little forward momentum for the US dollar at the start of 2019.

While Ghana’s currency has been losing 8% against the USD per annum over the last 15 years, a weakening dollar may mean the reverse. Experts forecast a tilt towards a weakening dollar given the way the currency has so far performed in 2019. This is due to America’s economic expansions slowing down which is having a knock-on affect across the globe.

The US dollar, which FXCM notes has a currency pair with all major currencies including the Ghanaian cedi, remains the most traded in the world. This is why any fluctuations in price have long lasting impacts on economies. The good news for countries like Ghana is that a weakening dollar can also mean higher opportunities for accumulating reserves.

Richard Franulovic, head of FX strategy at Westpac, told Forex Crunch that the majority of downside US data surprises are coming from the business sector. This makes it harder for the greenback to pull off a comeback before the year ends.

Brexit is still unfolding

The result of the impending Brexit deal will have a big impact on the future of the GBP in the coming years. The British parliament has recently called for a snap election following deadlocks on the Brexit negotiations. Experts, however, argue that these elections won’t be enough to quell the uncertainty surrounding Brexit. If the UK parliament passes a deal, the GBP would likely continue at its current value. Also a no-deal scenario would lead to a weaker GBP. As the GBP is one of the world’s strongest currencies any weakening will have huge implications across the globe.

Japan deflation far from over

Last month, Japan’s Economic Minister Nishimura said that the country has not completely emerged from deflation but the economy is making progress. The Bank of Japan also claims that it’s recovering after the government’s moderate measure of increasing the country’s money supply. Japan’s monetary policies impact the yen by maintaining low-interest rates in a bid to boost the economy. Despite this it continues to devalue against the dollar and the Euro.

However, the yen, which has been regarded as a refuge currency for years, could end up in a very unfavourable position amid the US-China market rivalry.

US-China trade wars

While there was a temporary truce between US President Trump and China’s President Xi Jinping recently, the trade war is far from over. President Trump has yet to relinquish plans to go ahead with the December round of tariffs on Chinese goods.

Concerns over the trade war has been pushing commodity currencies such as the Australian dollar to slip to 0.34% versus the US dollar in Q4. The year is about to end but negotiations between the two economic giants have seen little progress.

Interest rate cuts

Lastly, global central banks cutting interest rates have been creating waves on the Forex market. They are loosening monetary policy to offset the global slowdown aggravated by the trade war. However in Ghana, the Monetary Policy Committee held on to the 16% interest rate despite a sluggish economic growth. The unchanged stance throughout the year considerably weakened the Cedi but it has since recovered in the third quarter.

About Auther

Anna Scanlon is a finance writer with a passion for following global trends. Her current goal is writing about fiscal transparency across the world and what the future will hold for the global economy. When she’s not working, she spends time with her two daughters Maria and Judie.

—