US DOLLAR/CANADIAN DOLLAR (USDCAD) – BEARISH FAKERY SETUP AT KEY LEVEL;

The bearish momentum on the USD/CAD Pair which became apparent in the month of June remains valid. Last week, we saw a bearish fakery setup develop at key resistance level 1.32827 as the president of the United States, Donald Trump tweeted that the US Dollar is too strong and that a strong Dollar does not make US exports competitive in the international markets and so the Fed should take steps to weaken the US Dollar.

This presents no brainier selling opportunities for traders who aren’t already short on this pair.

Trade Idea;

Our reference key level is 1.32827 and traders who aren’t already short on this pair may zoom unto intraday time frames such as the H4 Chart and sell short on any strength near 1.32827 with stop above 1.33502 as trading activities picks up this week. See chart below for reference;

- EURO DOLLAR DOWNWARD (EURO/USD) – BEARISH PULLBACK TESTING KEY RESISTANCE LEVEL

The Euro Dollar has continued to tumble in the midst of the continuous global geopolitical and economic tensions. The Euro Dollar which has been trading lower throughout this year continue to show signs of further decline.

The pair made a two year low at 1.10465 during the opening of the month of August and has pulled back to test near term key resistance level 1.12405.

Trade Idea;

The various bearish Price Action signals we’ve seen over the last couple of days as the market tests 1.12405 key resistance level suggests that bears are still in control of this market. Traders may therefore look to sell strength on this pair as trading activities picks up this week with a stop right above 1.12618.

See chart below for reference;

- DOLLAR-SWISS FRANC (USDCHF) – DOWNWARD TREND REMAINS INTACT

We continue to see massive selling pressure on the USD/CHF as price continue to plunge intensively.

Near term relevant resistance level can be spotted at 0.97651 – 0.98160.

Trade Idea;

Downside target for short sellers can be found around 0.95971 and possibly lower. Traders who aren’t already short may consider entries upon upside retracement to mean price levels within the zone 0.97651 – 0.98160 during the course of this trading week.

See chart below for reference;

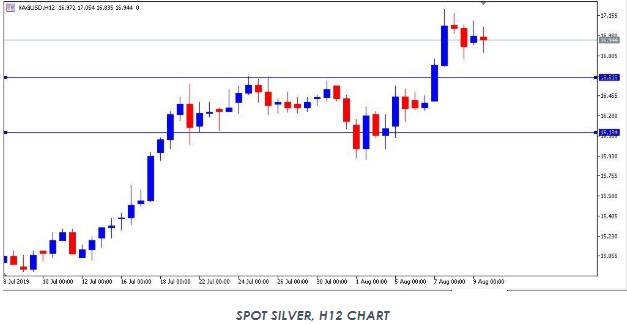

- SILVER SPOT (XAUUSD) – BULLISH BIAS REMAINS SOLID

Last week I discussed two bullish pin bar buy signals on spot silver and indicated them as potential buying opportunities. The set up appeared to have worked out nicely as we saw spot silver rally buoyantly during last weeks’ trading session.

Trade Idea;

Apparently, near term support can be spotted around 16.619 and traders not already long on silver spot may watch for buying signals within the zone 16.134 – 16. 619 as trading session unfolds this week.

See chart below for reference;

- SPOT GOLD (XAUUSD) – MAINTAINS BUOYANT STEAM

Last week, we saw Spot Gold trade buoyantly above near term support level 1431.93. Which is a set up I had discussed in my market analysis last week.

The current Price Action dynamics surrounding Spot Gold indicates that bulls are still in control, hence, we would continue to assume a bullish stance on this pair this week and look for valid buying signals as price retraces to mean levels using the 10 period Exponential Moving Average (EMA) as reference on the H12 price chart.

Trade Idea; consider looking for buying signals on Spot Gold within the zone 1452.89 – 1475.01

See chart below for reference;

Want more trade setups and trading ideas? My trading community members receive daily Price Action Analysis and Trade Ideas. Take the stress out of your trading by Signing up for my trading community membership.

Learn simple but powerful Advance Price Action Trading Methodology without indicators to enhance and simplify your trading;

- Low frequency trading and trading around a busy life;

- Coaching and mentoring;

- Market Price Action Commentary;

- End of Day Trading;

- Guide to installation of professional trading software platform;

- Effective customization of MT4/MT5 Platform;

- No Mobile phone trading;

- Guide to professional market price action analysis;

- Effective Money Management Strategies;

- Trade forex, stock indices, commodities and metals;

About E.O. Essien

E.O Essien is a Chartered Financial Economist with accreditation from the Global Academy of Finance and Management (GAFM) and the Association of Certified Chartered Economist (ACCE). He is a Professional Forex Trader, Trainer and Coach who received his professional Trading Education from Nial Fullers’ Online Price Action Trading Course. Where he obtained the trading strategies and success secrets used by Millionaire Trader Nial Fuller and many prop firms who trade stocks, bonds, commodities, currencies etc.

He is the founder of Knowledge and Action Price Action Trading Community, the fastest growing community of forex traders in Ghana.

Call or whatsApp +233 240080104 or Email; elijahotoo.eo@gmail.com for lifetime VIP Membership. Enjoy 20% discount in August.