Cryptocurrency analysts are urging the Bank of Ghana to expedite processes to formulate laws to regulate their business. They want the regulator to step in to avert a possible controversy between it and patrons of the product.

The increasing interest in the use of cryptocurrency has been met with mixed reactions considering the complex nature of the system.

Some have advocated for the model to be accepted in Ghana’s financial system while others have argued against the move.

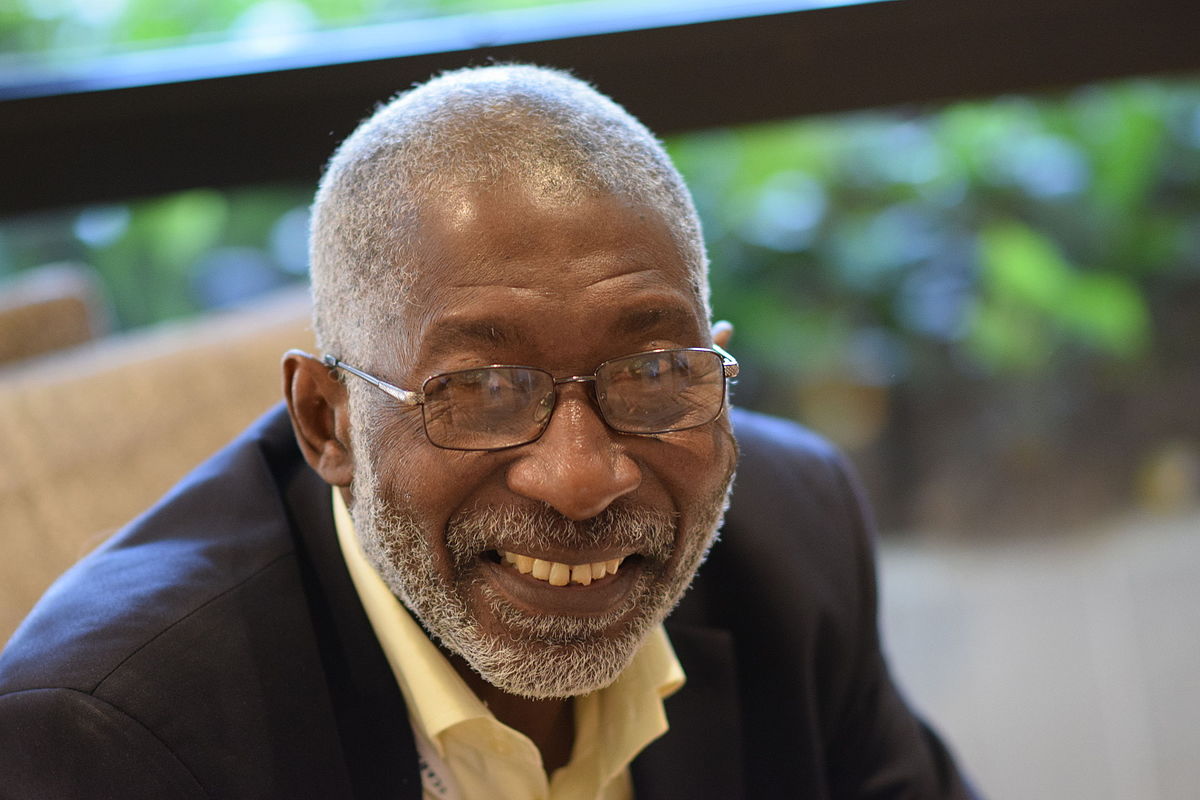

But an advocate of Cryptocurrency, Professor Nii Narku Quaynor believes addressing the regulatory gap should be of priority to the Bank of Ghana.

“So for you to say you will not adopt it, you must show me an alternative because if your mobile money that you send among yourselves, is not recognized in the US. But if I send you crypto currency, you can send it to somebody in Russia because it is recognised. So we need to go through all those thought processes and I am glad that the central bank is open enough to have a discussion ensuing because if you act too quickly, you tend to kill investments and innovation so let’s have a dialogue,” he argued his position to Citi Business News.

He admitted to the need to scrutinize various innovations albeit within appreciable pace of the innovation process: “I accept as a Computer Scientist that every one of our things goes through a long period of scrutiny as it may have negative impact or ethics issue.”

‘Invest 1% of dollar reserve into bitcoin’

The Vice President of Groupe Nduom, Papa-Wassa Chiefy Nduom, has earlier urged the Bank of Ghana [BoG], to consider investing foreign currency reserves into bitcoin.

Chiefy Nduom, a Bitcoin enthusiast with a background in banking technology, said that the bitcoin cryptocurrency could become digital gold for Ghana and other countries on the African continent.

“Just as investors will take gold and store it in their banks around the world to hedge against risks that they can’t perceive because they can’t predict the future, people are doing the same thing with bitcoin. I think the Central Bank should look very carefully into putting maybe up to 1 percent of our dollar reserves into bitcoin, studying the space and announcing to the world that we are going to be open for investment in bitcoin… we need to be heavily invested in these areas,” he said.

Cryptocurrency not licensed – BoG

The Bank of Ghana has cautioned the public against transacting business with digital currencies such as Bitcoin, in Ghana.

According to the Central Bank, it has not licensed the activities in digital currency under the Payments System Act 2003.

“The Bank of Ghana wishes to notify the general public that these activities in digital currency are currently not licensed under the Payments System Act 2003 (Act 662),” a statement on the development said.

It further indicated that the central bank is deepening its laws on electronic and financial transactions in line with international standards and the evolving electronic payments landscape.

Prof. Nii Narku Quaynor further observed that any delay to tap into the opportunities of the crypto currency regime could worsen its situation when it is rather exposed to artificial intelligence.

“In fact if you think blockchain is troublesome, you wait till artificial intelligence steps in,” he added.

Meanwhile he is confident a regulated system should reduce instances of ponzi schemes by illegal operators within the blockchain space.

“Those who are behaving like clubs; they will meet periodically but eventually you will see those who have taken their money earlier will stop coming and there will be less and less money for the new entrants. But it’s all because it’s not been recognized; if it’s been recognized and you can walk to a bank and get your crypto, who will go to that club?” he queried.

citibusinessnews.com