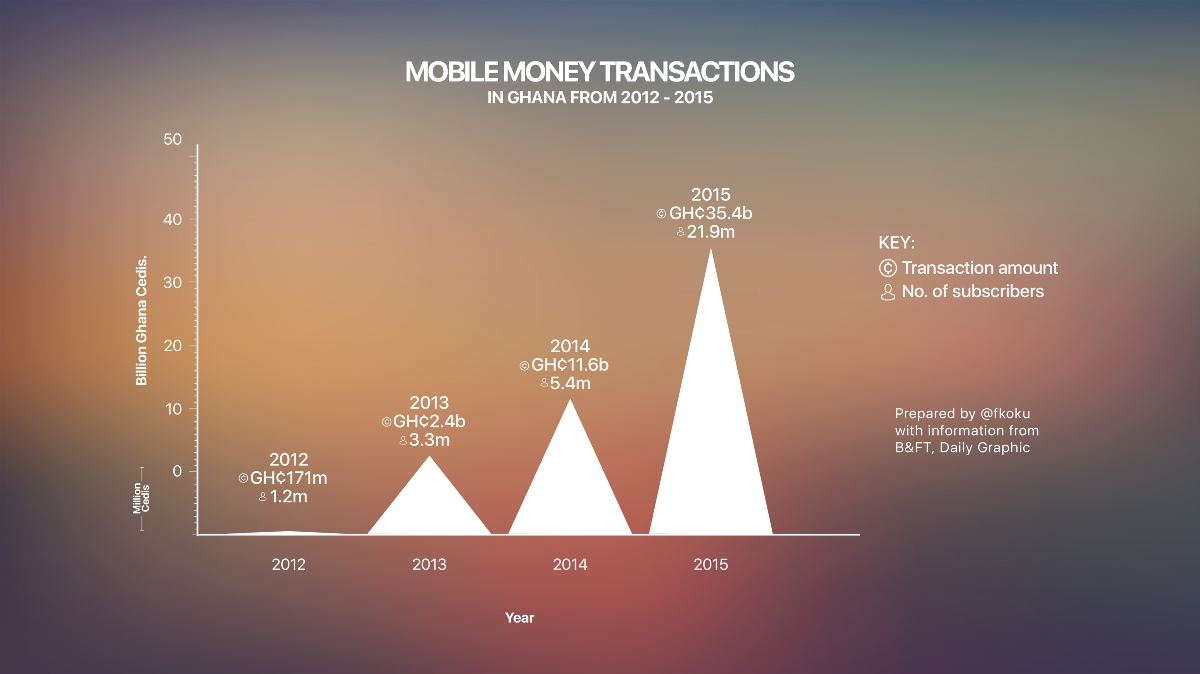

Today, not only does mobile money allow us to quickly send money to Friends and Family, it also saves us all the time and costs involved in having to wait in long queues at the banks. Little kiosks have sprung up around almost every corner or street granting the convenience of sending or receiving money. Truly, what started probably from one Telco network is now seeing an entry of almost all networks operators and is now recording huge numbers in transactions and subscriptions which now stands boldly at 21.9m.

From figures released by the Telcos involved in this new phenomenon, mobile money is recording amazing profits and shaking up the financial services industry. A few years back, the process of sending money to and fro wouldn’t go without some bank costs, precious time wasted in a queue at a bank, or probably filling out a few forms, lots of assistance was needed to make a simple and quick transaction. However, the emergence of mobile money has given more and more Ghanaians the platform to engage in quick peer-to-peer money transfers. Now students are receiving their stipends easily from parents, urban folk can now send money easily to families in the rural areas and vice versa without the associated hustle or the seemingly verbose forms by the banks. In a nutshell people are getting comfortable with e-money and the concept of money on a device.

As of 2015, the mobile money service in Ghana had about 21.9 million subscribers proving the readiness of the Ghanaian market to adapt quickly to cashless money platforms. A Visa study found that, there is high awareness of mobile money services and capabilities among consumers in developing economies. Across the six countries surveyed, average awareness stood at 56% and three countries stood out in particular: In Ghana, awareness was at 93% with MTN identified as the most known mobile money provider. It also showed that 67% of Ghanaians feel they have a “clear understanding of mobile money”. This provides us a clear picture of the immense impact mobile money services are already establishing in the Ghanaian financial services market.

With over Ghc 30 billion recorded in transactions in 2015 alone, Sika is extremely excited about the progress made in the FinTech ecosystem and the future this holds for the “Cashlight” economy Ghana envisages.

#SikaIsComing

Credit: SIKA Inc

SIKA is a personal finance app that replaces your bank with a smarter financial experience, all done on your mobile phone.