Globally about 2 billion adults lack access to formal financial services. And the case is not different in Ghana and most part of Sub-Saharan Africa. But with the arrival of mobile money technology, most nations across the continents are embracing the need for financial inclusion through mobile money. It is widely touted as a driver for financial inclusion in many developing countries. In Kenya and Tanzania; more adults have mobile money accounts than bank accounts. Ghana is joining the bandwagon but it is estimated the country is doing that at a slower pace compared to that of the success stories of Kenya and Tanzania. Currently, Kenya and Tanzania are the market leaders in mobile money accounts for countries in Sub-Saharan Africa. The prospects looks brighter as Ghana’s mobile money users doubled between 2014 and 2015, with transaction volumes tripling from 2013-2015. The advent of mobile money accounts has brought many attendants’ benefits to the individual and the nation as a whole. Some of the benefits are discussed below.

Financial Inclusion

Financial inclusion is defined as the ability of an individual, household, or group to access appropriate financial services or products. Without this ability people are often referred to as financially excluded.

In Ghana and most sub-Saharan African countries, financial exclusion is very high mainly among rural folks due to the inability to access financial services, and some conservative beliefs about the financial system.

According to a report by The Consultative Group to Assist the Poor (CGAP, 2015), 20% of the Ghanaian adult population has mobile money accounts with about 17% being active accounts. Rural population in Ghana was last measured at 12,484,698 in 2014, according to the World Bank. These same inhabitants may live under or on less than $2.50 per day. Mobile money in Ghana has emerged as a driver of financial inclusion and rural access has doubled since 2010. 60% of the mobile money users are urban dwellers as compared to the 40% rural dwellers. And 81% of those who live under $2.50 dollars have mobile money accounts. 91% of adults in Ghana own mobile phones and this can be attributed to the double transaction volumes of mobile money accounts from 2014-2015 and triple transaction volumes seen from 2013-2015 (CGAP, 2015)

The advent of the mobile money in Ghana in essence is contributing to the financial inclusion for many Ghanaians, especially rural dwellers who were previously excluded. Access to mobile money technology is growing as per the figures given above. And will continue to rise with the appropriate legislation in place. Technology start-ups with focus on mobile payments are also driving this inclusion through mobile money technology.

Savings

Wikipedia defines savings as income not spent or deferred consumption. Developing countries mostly in sub-Saharan Africa have a low savings rate. Several factors account for this low rate in savings. But it’s interesting to note mobile money is contributing to a growing trend of savings among Ghanaians.

On savings, 67% of Ghanaian adults save which is a good trend (CGAP, 2015). Mobile money will seek to further stretch this with the growing numbers of mobile money subscribers. Ghana has excellent underlying conditions for mobile money – including literacy, numeracy, phone ownership, and phone usage for mobile money, and new regulations passed in July 2015, which has made it easier for mobile money service providers to operate. These developments in the long run ease the burden on mobile money operators.

In the survey conducted by The Consultative Group to Assist the Poor (CGAP, 2015), it came to light that domestic remittances were the main drivers for the increased use of mobile money. Ghanaians are financially active – for instance, 86% of active mobile money account holders save – they are generally using their mobile money accounts for these purposes. Savings on mobile money is used for payment of bills, and pay in person for goods or services (DSTV subscription fees, Utility bills, buy tickets for events and airlines and buses for traveling).

Innovation

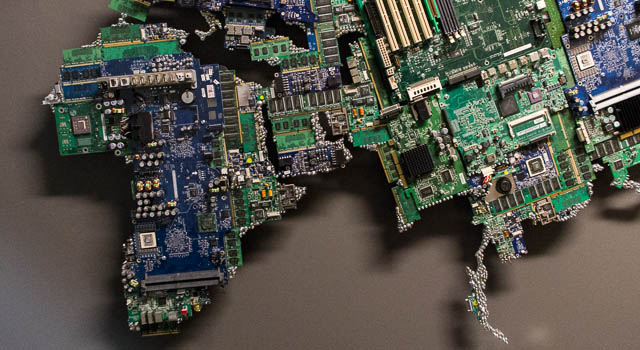

Businesses are springing up around mobile money operations. There’s a new wave of technology entrepreneurs pushing their business operations around mobile money. They are developing new products which seek to enhance the use of mobile money for business transactions.

Digitizing existing payments streams that are currently occurring in cash is a great opportunity for mobile money growth in Ghana. There are some digital payments cropping up but at a slow pace. SlydePay, Paypal, ZeePay and others are around but not popular among the local consumers. What these new entrepreneurs riding on the back of mobile seek to do is to bridge these divides in fully utilizing the enormous benefits with mobile money.

Ghana is well poised for mobile money to take off in the coming years with proper regulations and massive sensitization. The broad use of mobile money is yet to be developed in Ghana. Network operators need to enhance their systems and operations to check occasional network failures which hamper business transactions and can contribute to low patronage by users.

Author: Paa Swanzy-Essuman || p.swanzy@ghanatalksbusiness.com